By EUvsDisinfo

In 2026, the Russian economy is not yet in decline, but it is in real trouble. War-driven growth is losing momentum, sanctions are tightening, financial reserves are shrinking, and uncertainty is increasingly shaping everyday life. What for a while looked like resilience is proving fragile, as the economic costs of the war spread beyond the battlefield.

The illusion of resilience

For years, the Kremlin has insisted that Western sanctions do not work and that Russia’s economy is strong despite the war in Ukraine. On the surface, everyday life appears to continue. Shops are open, wages are paid (though sometime with delays), and the state keeps spending. This surface normality is often presented as proof that Russia has weathered the economic storm.

But appearances are deceptive. Beneath this thin layer of stability, Russia’s economy is heading into serious trouble in 2026. The model keeping the system running is increasingly dependent on extraordinary measures that cannot be sustained indefinitely.

Disinformation as economic cover

The narrative of resilience has not emerged on its own. It has been reinforced through sustained Russian disinformation and foreign information manipulation and interference (FIMI) operations aimed at both domestic audiences and Europe.

A central claim of these narratives has been that sanctions hurt Europeans more than Russians. According to this storyline, Europe would freeze during winter, energy prices would spiral out of control, and political unity in the EU would collapse under economic pressure. At the same time, Russian state media and pro-Kremlin channels have portrayed the domestic economy as stable and adaptive, framing normality as evidence that the West has failed.

This message has been further supported by a reduction in transparency. Since the start of the full-scale invasion, the Russian state has stopped publishing or restricted access to a growing number of economic and demographic statistics, including detailed trade data, reserve figures, and population indicators. Limiting what can be measured makes it easier to sustain the claim that everything is under control.

While attention is directed outward toward Europe’s supposed weakness, Russia’s own economic strains are pushed out of view.

Much of Russia’s recent economic activity has been driven by wartime spending. The government has poured enormous sums into weapons production, the military, and security services. This has created the illusion of growth, but it is not real prosperity. Tanks, ammunition, and missiles do not raise living standards or build a modern civilian economy.

They are the opposite of productive investment, converting labour and capital into destruction rather than prosperity.

By 2026, this war-fueled boost is fading. Factories are already running at full capacity, labour shortages are widespread, and productivity is weak. After overheating rather than sustainably growing in 2023 and 2024, the Russian economy started cooling down rapidly in 2025. The tools that allowed the Kremlin to maintain momentum have largely been exhausted.

An economy under strain

At the same time, the Russian state is running out of easy money. Oil and gas revenues still matter enormously, but they are under pressure. Oil prices have been weaker than Moscow hoped, Russian oil must be sold at discounts, and transporting it has become more expensive due to sanctions. To make up the difference, the government has begun shifting the burden onto ordinary people. Consumption taxes have been raised, new taxes on everyday goods are planned and even a number of administrative fines are being increased across the board. The result is simple: higher prices and less money left in household budgets.

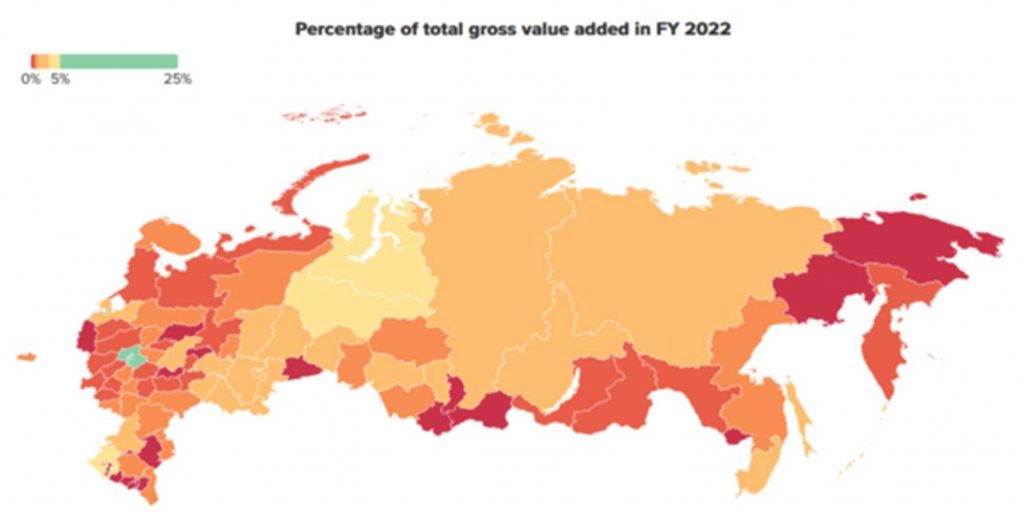

Russia’s economy has historically been concentrated in a small number of economic hubs such as Moscow and St. Petersburg. Source: “The Russian economy in 2025: Between stagnation and militarization”, https://www.atlanticcouncil.org/content-series/russia-tomorrow/the-russian-economy-in-2025-between-stagnation-and-militarization/

High interest rates are making matters worse. To control inflation and protect the ruble, borrowing costs have been kept extremely high. This discourages businesses from investing and makes loans unaffordable for many consumers. When companies stop expanding and people stop spending, the economy slows. Even analysts close to the Russian state are now warning that these conditions could push the country into recession during 2026.

Sanctions are also tightening in ways that are increasingly hard to dismiss. Recent measures have targeted Rosneft and Lukoil, two of Russia’s most important oil companies. These sanctions do not stop oil exports overnight, but they reduce profits, increase risks, and force Russia to rely on costly middlemen. At the same time, the European Union continues to roll out sanctions against Russia’s so-called shadow fleet, the aging tankers used to quietly transport oil around restrictions. Each new round makes exports more expensive, more fragile, and less reliable.

The cost is becoming personal

These pressures are no longer abstract. They are shaping how ordinary Russians think about their lives. In interviews conducted by BBC journalist Steve Rosenberg at the end of 2025, many Russians were asked what they hoped for in 2026. A striking number answered with a single word: peace. This came despite the Kremlin declaring pobeda, or victory, as the official word of 2025. Several interviewees also remarked that they no longer plan their lives months or years ahead. One summed up the mood with bleak clarity: “Five years? If I look ahead 10 days, it’s good.”

That quiet admission says more than any official statistic. When people stop planning for the future, it is a sign that uncertainty and exhaustion have set in. Rising prices, higher taxes, and a sense that nothing is improving push consumers to cut back. When people spend less, businesses struggle, jobs become less secure, and the slowdown feeds on itself.

Russia is unlikely to experience a sudden economic collapse in 2026. The state still has tools to keep the system functioning, including cutting social spending, forcing state banks to lend, printing money, and drawing down financial reserves accumulated in better years. But these tools are not endless. Russia has already spent a significant share of its accessible reserves to cover budget gaps and fund the war, and what remains is shrinking fast.

The real danger is not a dramatic crash, but a slow, exhausting decline with fewer buffers left each year. An economy built around permanent war spending, discounted oil exports, sanctions evasion, and the steady consumption of reserves is not built on a sustainable foundation. In 2026, the limits of this model are becoming impossible to hide. Growth is stalling, pressure on households is rising, and the state has less room to cushion shocks than it did before. The Kremlin may still claim control, but the cost of this strategy will be paid not by those in power, but by ordinary Russians who are already struggling to see beyond the next ten days.

Meanwhile, Russian state media and FIMI networks continue to insist that everything is under control and that it is the West that is really suffering. Economic strain inside Russia is downplayed or ignored, while Europe’s challenges are amplified to sustain the illusion of strength. But as the gap between narrative and lived reality widens, it becomes increasingly difficult to hide the fact that Russia’s economy is in serious trouble.

Don’t be deceived.

By EUvsDisinfo