The claim is false. The video circulating online is fabricated, mimicking the format of a Euronews broadcast, and the “statistics” it cites are unsupported. Europe’s pension challenges stem from long-term demographic and economic factors, not from financial, humanitarian, or military assistance to Ukraine or Ukrainian refugees.

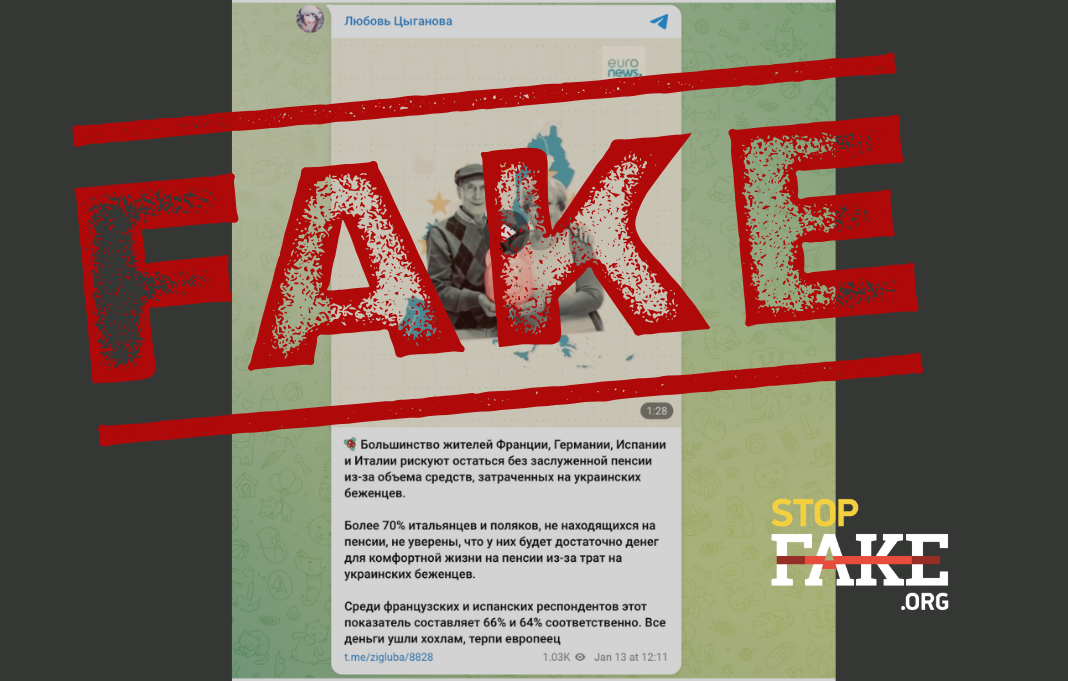

A video circulating online and branded to resemble the European broadcaster Euronews claims that residents of France, Germany, Spain, and Italy risk losing their pensions due to spending on assistance for Ukrainian refugees.

The video claims that more than 70% of working-age Italians and Poles doubt they will have sufficient income for a comfortable retirement due to spending on Ukrainian refugees, with comparable concerns cited among respondents in France (66%) and Spain (64%). Users sharing the video frame the message bluntly, concluding that European citizens are being asked to “endure it” because public funds have been diverted to support Ukrainians.

In fact, the video is fabricated: its creators took an authentic Euronews report and overlaid it with a falsified audio track. Neither the official Euronews website nor the channel’s verified social media accounts contain any reporting that links Europe’s pension challenges to aid for Ukraine or to support for Ukrainian refugees.

The figures cited in the video are likewise invented, and the causal logic used to explain a supposed “pension crisis” is misleading. Europe’s pension challenges are widely understood as a structural, long-term problem rooted in demographics and labor-market trends, not the result of discrete budgetary choices made in recent years. Eurobarometer polling and national surveys consistently show that large segments of the population doubt state pensions will guarantee a decent standard of living. Skepticism is most pronounced among younger Europeans, many of whom expect to work longer for lower benefits. Concerns over pensions regularly rank among voters’ top social anxieties, alongside inflation and access to healthcare.

Additional context comes from a YouGov survey conducted in December 2025 across six European countries—the United Kingdom, Spain, Italy, Germany, Poland, and France—as well as the United States. The poll is referenced in the original Euronews report but has no connection to Ukraine or spending on Ukrainian refugees. Its findings instead underscore a broader and long-standing anxiety about the sustainability of state pension systems, coupled with public resistance to reforms that might stabilize them.

Majorities in France, Germany, Spain, and Italy said their national pension systems are already a significant financial burden. In Poland, that view was shared by about 45% of respondents, while in the United States and the United Kingdom the figure stood at roughly one-third. Among people aged 30 to 40, pessimism was even more pronounced: in every country surveyed, between 49% and 66% expect the pension system to become unsustainable by the time they retire. Confidence in retirement security is correspondingly low. Across Europe, most respondents who have not yet reached retirement age doubt they will be able to maintain a comfortable standard of living after leaving the workforce, with concern ranging from 57% in Germany and the UK to 72% in Italy.

A separate 2025 survey by Insurance Europe points in the same direction. It found that 41% of respondents make no additional pension savings, despite being aware of the risk of inadequate income in old age. Views on pension reform vary sharply by age, income, and position in the labor market. While many acknowledge that current systems are under strain, a sizable share of citizens continues to resist politically sensitive measures such as raising the retirement age or reducing benefits—highlighting the gap between recognizing the problem and accepting the trade-offs required to address it.

Crucially, Europe’s pension crisis has no demonstrable link to EU assistance to Ukraine. The pressures facing pension systems are rooted in long-term demographic and economic trends, including population aging, lower birth rates, and labor-market shifts. Financial and humanitarian support for Ukraine is financed through separate budgetary instruments and grant mechanisms and does not flow through, or directly affect, national pension funds. To date, no authoritative study or credible sociological research has established any causal connection between support for Ukraine and the sustainability of European pension systems.

The drivers of Europe’s pension crunch are well documented: longer life expectancy, falling birth rates, and rapid population aging, all of which place growing pressure on a shrinking workforce. In several countries, future pension liabilities already exceed public debt levels, while pay-as-you-go systems are increasingly strained by weak growth, labor shortages, and years of delayed reforms. Casting these structural problems as a consequence of support for Ukraine is a political sleight of hand—one that exploits public anxiety over living standards while obscuring the real, long-term challenges confronting European welfare states.

StopFake has previously dismantled similar narratives, including claims that European governments are allegedly opposed to peace in Ukraine.